Section 581

Legal loopholes, anonymous shell companies and absentee residents are all distinct characteristics of NYC's luxury housing market. Our contribution to the Sharing Models: Manhattanisms exhibit at the Storefront for Art and Architecture explores the inequalities driven by arcane tax code that continue to drive development across the City.

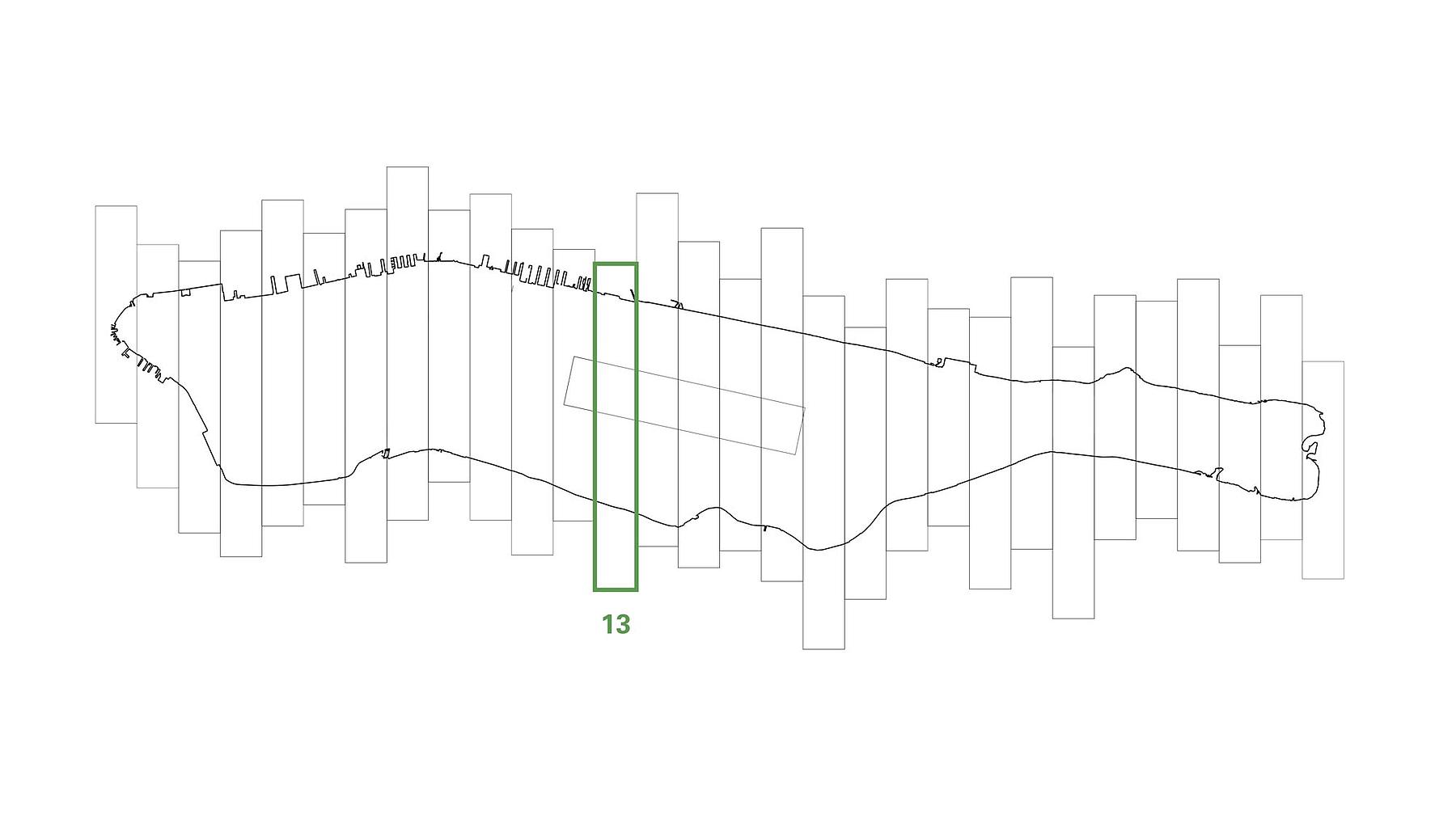

SITU’s contribution to an exhibit at the Storefront for Art and Architecture investigated inequalities incurred by New York State and City property tax code. Titled, Sharing Models: Manhattanisms, the show at Storefront exhibited 30 models and drawings by 30 international architects that represented various ways of reading, understanding, and analyzing the collective assets of urban life. For the exhibition that opened on July 14, 2016, Storefront divided Manhattan into 30 section cuts across the city from the East River to the Hudson River, and assigned each to a participating studio. Containing significant residential sections of the Upper East and West sides centered around Central Park, SITU’s assigned section for the exhibition is bounded by East 79th Street to the north and West 62nd to the south. In response to the exhibition’s call to explore the effect of emerging sharing economies on the lived experience of cities, SITU set out to render visible the disparities in property tax code and the loss of shared city revenue through New York’s luxury co-op and condominium market.

As the veils of limited liability companies are pierced and leaks from Panama converge on the same investments, it is illuminating to render visible the drivers of the built environment across a swath of Manhattan’s most valuable real estate and to project a future in which access and exchange of information play a greater role in shaping the City. It is also a moment to reflect on Michael Bloomberg’s enduring legacy of shoring up New York City’s standing as a hub of international luxury real estate investment and his largely unqualified conviction that concentrations of global capital are a net benefit to all citizens of the City.

SITU’s project, titled “Section 581,” borrows its name from the component of New York state property tax law that sets the assessment practices for Tax Class 2 residential buildings (coops and condos) in New York City. Property taxes on condos and co-ops in New York City are calculated based on an assessment of the property’s value conducted by the Department of Finance (DOF) and are not based on the sales price.

Section 581 follows:

"[R]eal property owned or leased by a cooperative corporation or on a condominium basis shall be assessed for purposes of this chapter at a sum not exceeding the assessment which would be placed upon such parcel were the parcel not owned or leased by a cooperative corporation or on a condominium basis."

In accordance with this law, co-op buildings and condo buildings with at least four units are valued by the DOF as if they were rental properties. These owner-occupied units are some of the most expensive in the city, yet they are compared to rental units across variables such as location, date of construction, and building size to determine their market value.

According to the report published by the Furman Center in July 2013 titled, “Shifting the Burden: Examining the Undertaxation of Some of the Most Valuable Properties in New York City”, the most valuable rental buildings in Manhattan are valued by the DOF at well under $500 per square foot. The market has seen luxury condo sales typically made at a much higher expense per square foot — often in the $4500 range.

The incongruities of such comps become evident even though a quick reading of the physical structures and amenities of the units themselves, as well as in the demographic characteristics of the people who live in them. In the case of newer luxury condos there are almost no rental buildings that are truly comparable. Furthermore, nearly 30 percent of rental buildings selected for comps are also rent stabilized, confounding the notion of arriving at co-op market values based on comparisons in rental income (rent stabilized income is artificially limited and therefore not subject to the market). The Independent Budget Office estimates that citywide, the discount this assessment system creates—which is referred to as the 581 discount—for condos is about 82 percent; for coops it is around 77 percent. In other words, only 18 percent of the market value of condos is included in the tax base.

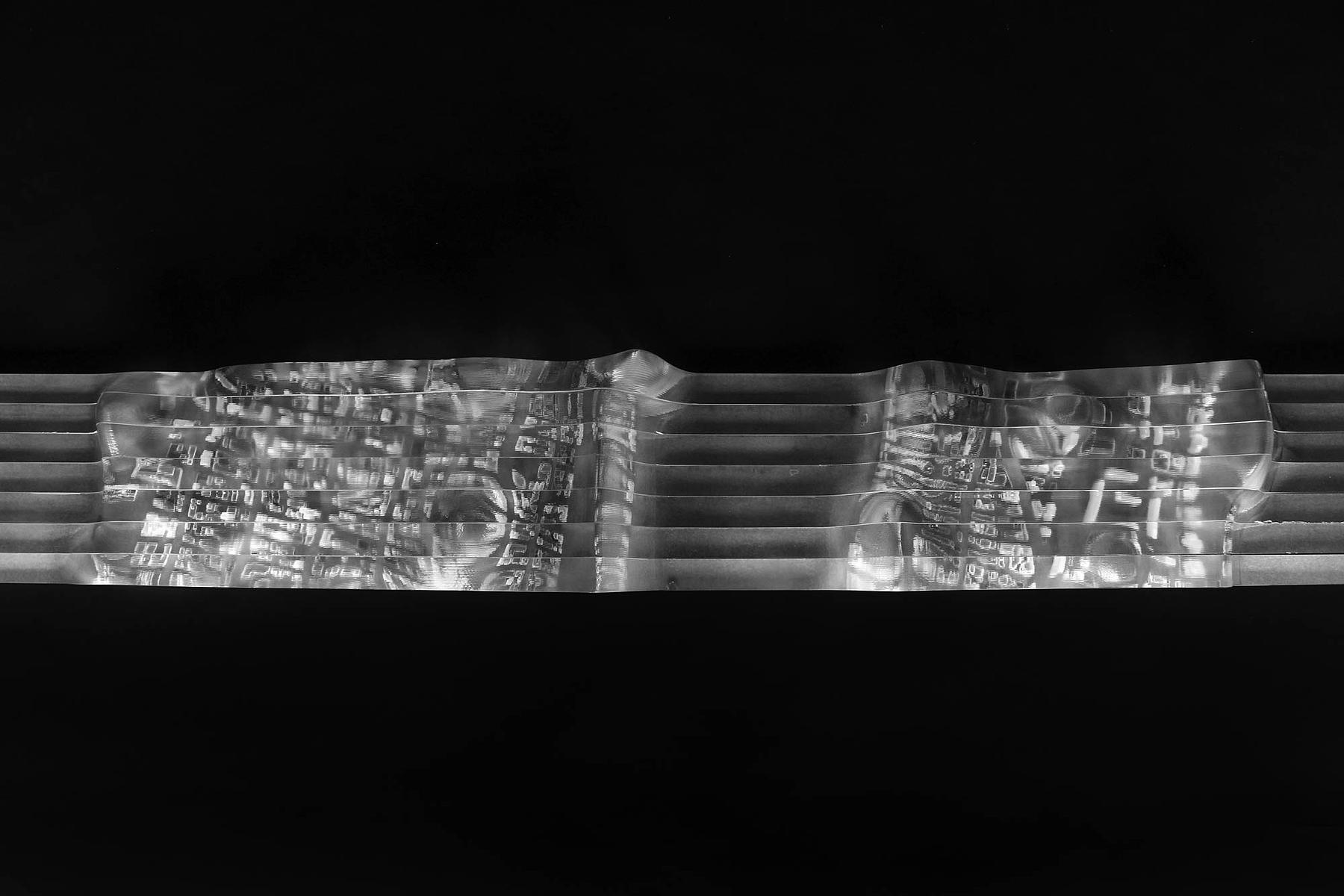

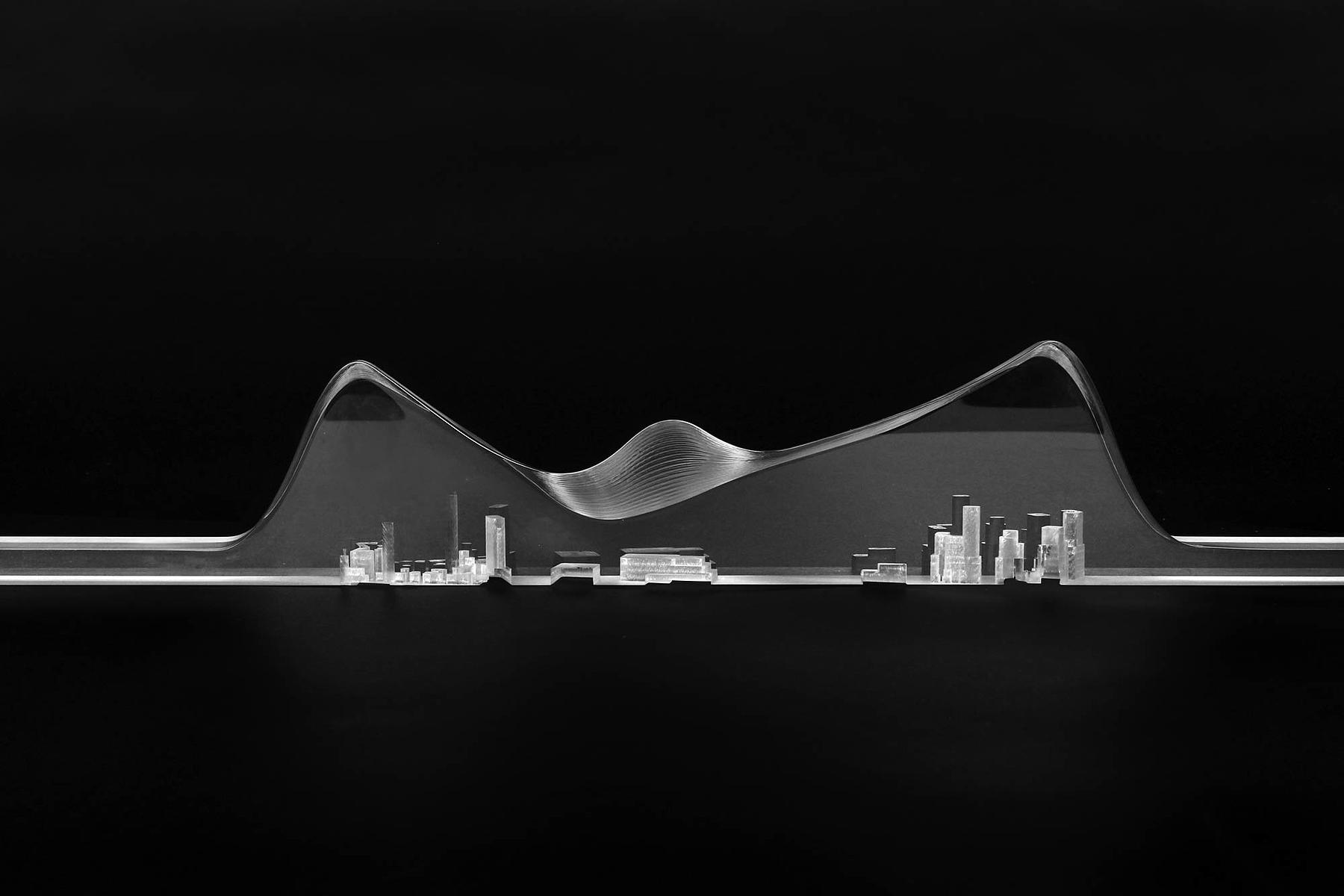

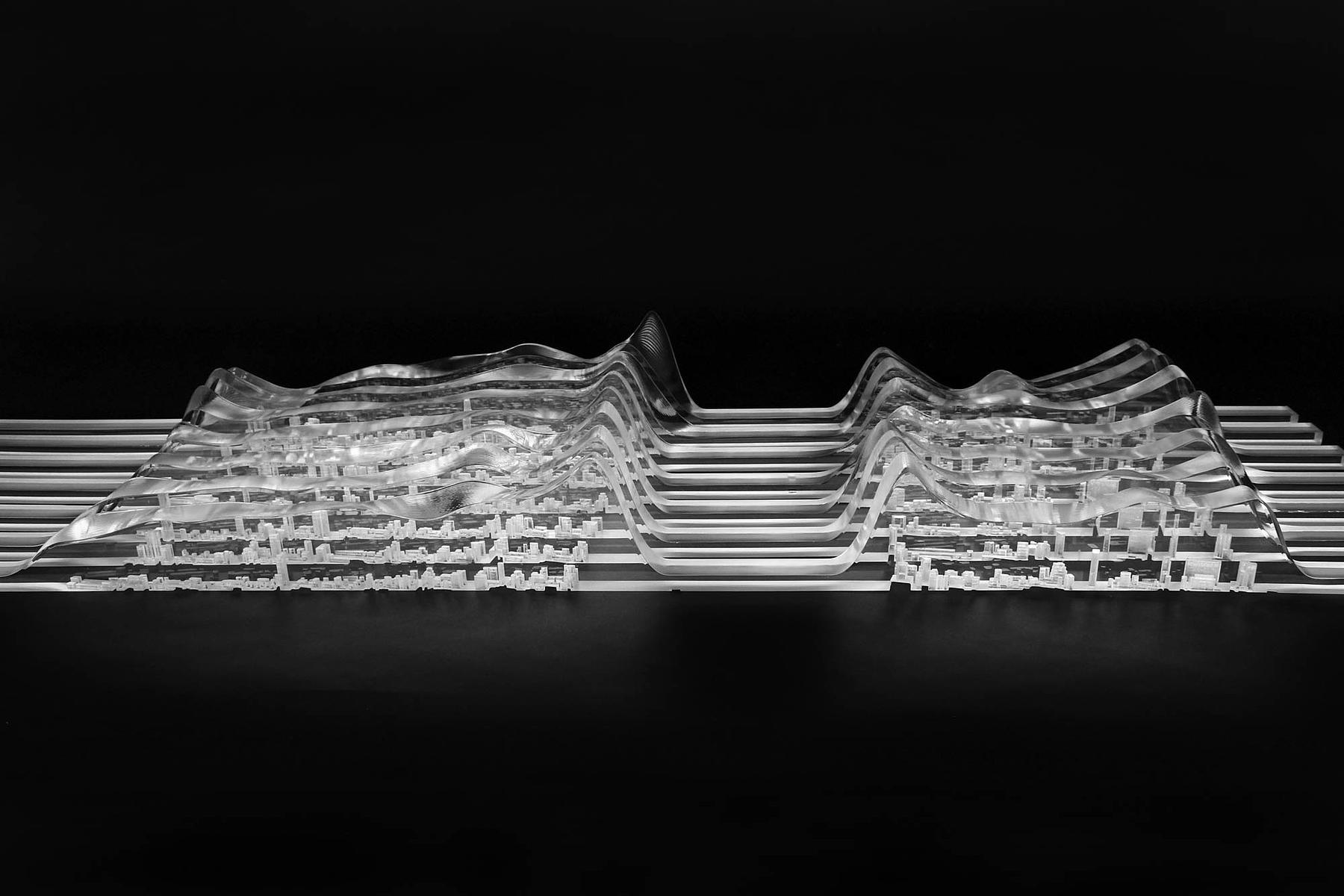

While the inequalities engendered by the real estate market leave many signatures on New York City’s built environment, the arcane model of calculating property tax and the misalignment of this process with the realities of the contemporary market are particularly acute. This condition is concentrated in the most expensive properties in the city – many of which are located in the area assigned to SITU by Storefront. We set out to explore this in greater detail through both physicalizing the relationship between sales prices and assessed values in our model and creating a drawing that unpacks selections of the underlying data.

Making use of NYC’s rich information commons, the model and drawings are based on analysis of available financial and geospatial datasets in the public record.

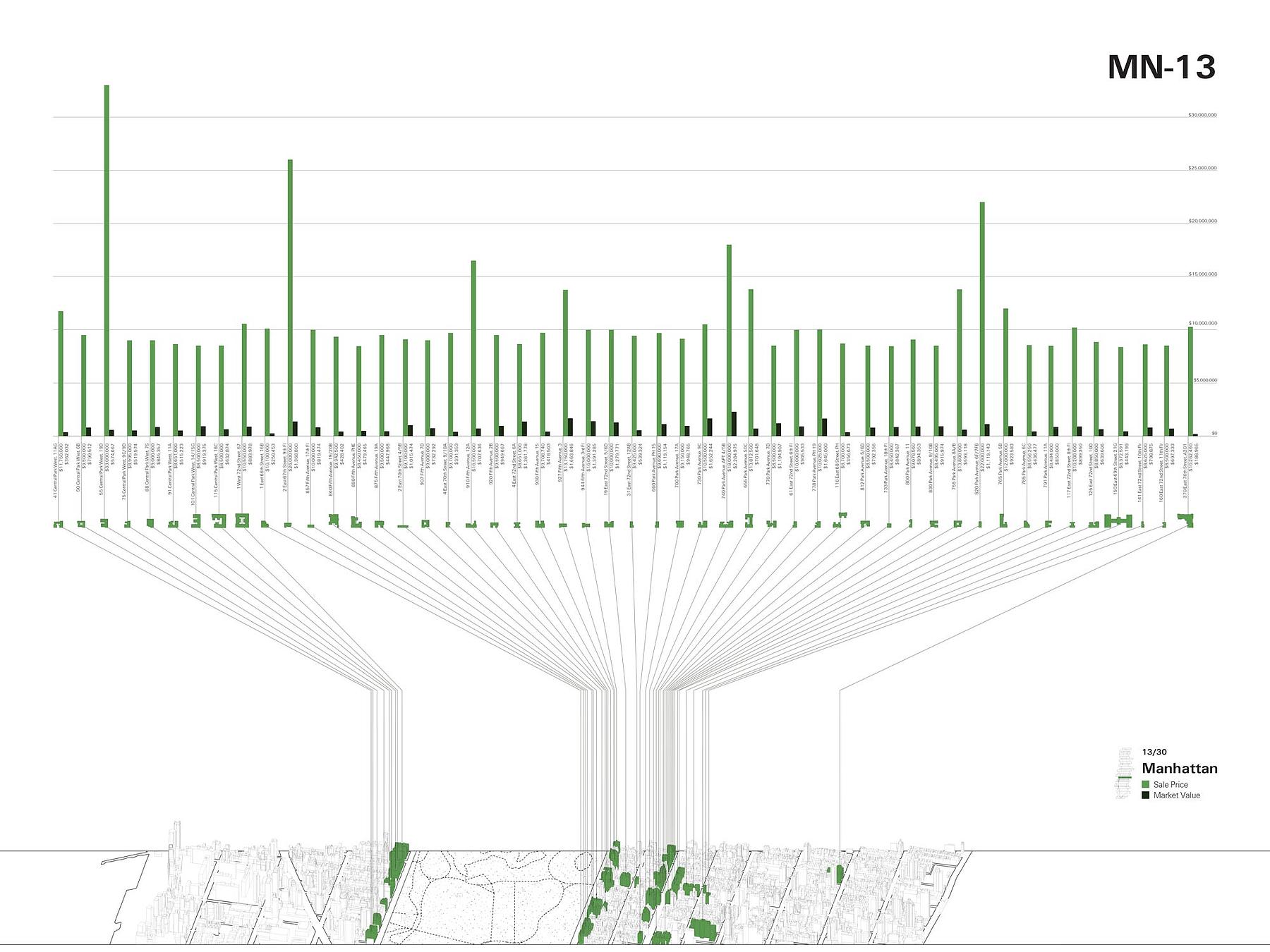

As part of our research for this project, SITU delved into available open data published by the NYC DOF and Department of Information Technology and Telecommunications (DoITT). Comparison figures for assessments draw from the Department of Finance’s property assessment roll for fiscal year 2017. Sales data were gathered through the DOF’s rolling and annualized datasets from the last 13 years (2003 to June 2016). Our process focused on the luxury co-op and condo sales in our section that were present in the data, of which there were 700.

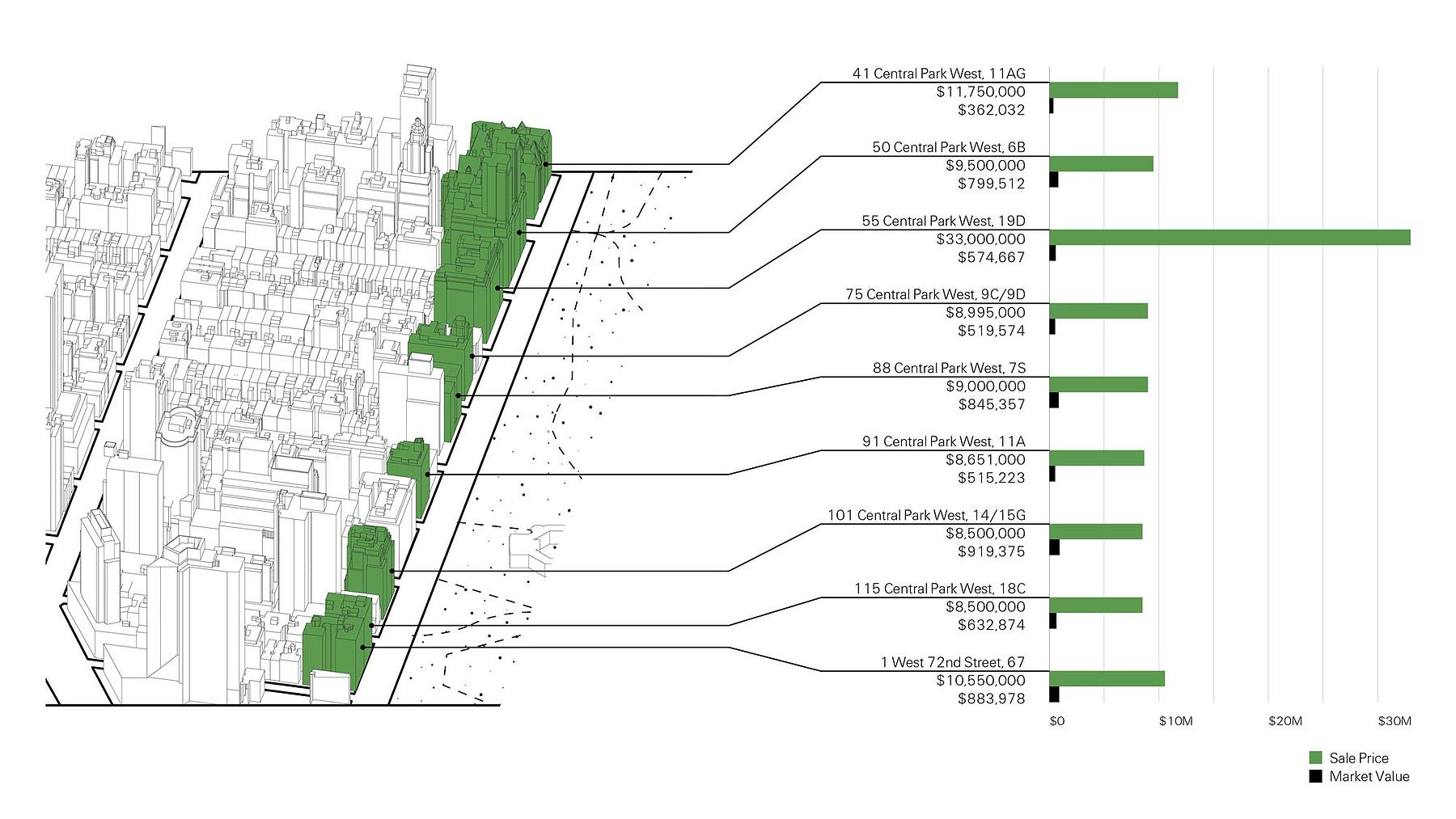

SITU found significant discrepancies in valuation. One of the most expensive recorded sales in our section was $33,000,000 for a single co-op unit in an 111 unit building on Central Park West. The city assessed the entire market value of the building –all 111 units– at $60,722,000 for the fiscal year 2017, only $28,000,000 over the sales price for just a single apartment in a luxury building of many. The sale price of that $33,000,000 apartment is nearly 60 times its value assessed by the DOF for tax purposes.

In SITU’s section of Manhattan, the highest disparities are concentrated along Central Park West and along Park Avenue, where some of the most expensive apartments in the entire city are located. Expanding this analysis across our area of interest reveals a total undervaluation of around $5.2 billion dollars in the luxury condo and coop market.

The drawing unpacks selections of the underlying data. It identifies the 50 most expensive of the 11,000 undervalued unit sales in our section and compares their respective sale prices to the values used for property tax assessment. This study represents a small fraction of the lost property tax revenue that could be captured across the entire city. As a general trend, the more expensive the sales price, the more extreme the disparity, in some cases numbering in the tens of millions of dollars for a single unit alone.

In the model, the height of the acrylic surface above a coop or condominium building represents the relative magnitude of difference between sales price and assessment value. It seeks to present a skewed reality wrought by Section 581 that is difficult to see: a real estate market that has benefited an elite class of New York home owners and disproportionately burdened the less wealthy with the funding of public life and works in the city.